In mining, billion-dollar decisions often rest on what happened months and years ago in the core shack—an unassuming shed near a potential goldmine where drill cores become data. Geologist David Newton should know. Early in his career, he spent long, cold days manually logging drill core data into sprawling Excel spreadsheets thousands of rows deep. “That’s where the rubber meets the road,” he says. “If logging errors slip through unnoticed, they can’t easily be fixed. And the crazy part is, the people logging that data are often the most junior, lowest-paid employees in the whole operation.”

In any industry where data underpins important decisions, precision is everything. This is especially true in gold mining, where the stakes have never been higher. Over the past decade, gold prices have increased by over 160%. In the last six months alone, they leapt nearly 30%, surpassing the $3,500 per ounce mark for the first time in history.

A golden opportunity

This extraordinary rise is doing more than boosting the value of portfolios—it’s flipping the script on the economics of mining. Mines that were mothballed decades ago and deemed too expensive to continue working are suddenly gleaming with promise. “When gold booms, the calculus of mining changes,” says Newton, who now works at Seequent, the leader in subsurface modeling and part of Bentley Systems, the infrastructure engineering software company. “What wasn’t worth digging out before is suddenly back in play. That’s why we’re seeing renewed interest in old gold projects.”

Aerial view of the Fimiston Open Pit in Kalgoorlie, the largest open pit gold mine of Australia.

Aerial view of the Fimiston Open Pit in Kalgoorlie, the largest open pit gold mine of Australia.But reviving a mine isn’t as simple as flipping the lights back on. Before they move a single rock, companies need to answer several important questions: how much gold is left, exactly where to find it, and how much it will cost to get it out. They also need to determine the mine’s impact on the environment. “The question isn’t, ‘Is the gold there?’ because we’ve long known it is,” Newton says. “The question now is, ‘Can we get it out economically, efficiently, and responsibly?’”

That’s where the digital transformation of mining is rewriting the rules. This new era of gold mining is being shaped not just by price, but by data-driven insight, intelligent collaboration, and connected tools built for the future. Seequent’s industry-leading software is already powering modern exploration. Its newly launched Evo, a cloud-based geoscience data and compute platform, for example, is pointing to a more connected, collaborative data ecosystem. Evo can draw valuable insights from past projects, work with the most up-to-date information, and include geospatial search powered by Bentley’s Cesium platform. Evo can also run artificial intelligence (AI) and machine learning applications. “Evo isn’t just a platform —it’s about sparking fresh ideas and transforming how geoscientists work,” says Seequent CEO Graham Grant.

From paper trails to AI

Many of the gold mines now getting a fresh look by the mining industry were shut down in the 1960s, ‘70s, and ‘80s, when gold prices were low and the relative cost of extraction high. Knowledge of the remaining gold’s location, quality, and quantity is often buried in its own way. “For mines closed back then, those data are on paper, or Excel spreadsheet files at best,” Newton says. “Even today, some customers still use paper for certain parts of their mapping workflows.” It seems that some geologists, not unlike the processes they study, evolve slowly.

Yet bringing such data into the digital age is now a core part of forward-thinking exploration. Mining teams have turned to Seequent and its software and platforms to digitize, organize, and re-analyze historical data. It allows them to unlock insights that were previously too scattered or siloed to use. And when that data becomes usable, so does the mine.

Good data is worth its weight in gold

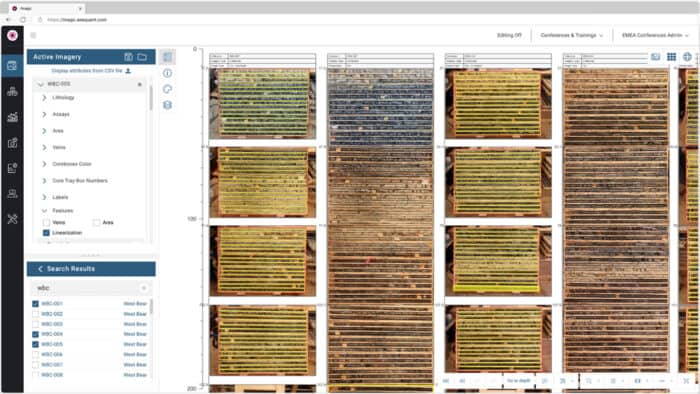

Automated drill core photo organization and optimization in Imago.

Automated drill core photo organization and optimization in Imago.Mining success hinges on one deceptively simple question: Where should we dig? The answer relies on a chain of data—beginning with exploration, sample drill cores logged, photos taken, samples assayed.

Seequent has assembled a powerful suite of data tools covering every step of the mining process—from exploration and drilling to modeling and resource estimation. Here’s how some of those products work together.

Take MX Deposit, a tool Seequent engineers and geoscientists designed to support core loggers and eliminate costly errors. It follows common standards to simplify data entry and securely store it in the cloud. Another software solution, Imago, adds high-resolution photography to the picture. It captures visual context and uses machine learning to automatically identify features or structures.

Then comes the modeling. Leapfrog Geo, Seequent’s flagship product, builds a 3D model of the subsurface, essentially interpolating drilling data and “connecting the dots” between drill holes to create a clear picture of what lies beneath. Leapfrog Edge takes that model further, applying advanced geostatistics to estimate how much gold—or copper, or any other resource—exists in the material between sample drill holes. “You could be looking for a centimeter-thick vein of gold, a kilometer deep,” Newton says. “You must know exactly where you’re going and how much there is.”

These tools are not only about accuracy and precision, says Newton. They’re also about trust. “When Seequent customers report a resource estimate, it can move their share price,” he says. “So that estimate has to be accurate—because if the gold isn’t there, the whole business case falls apart.”

Evolving an ecosystem

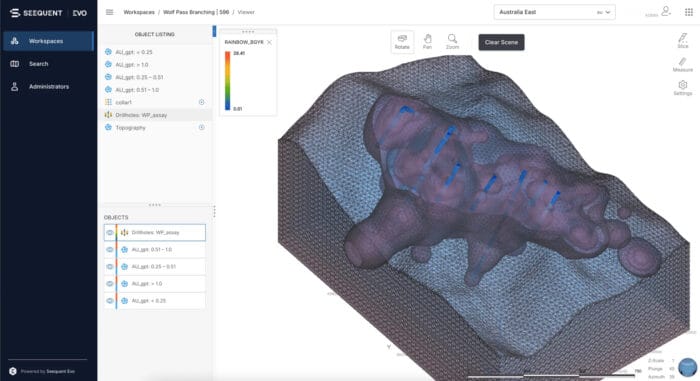

Drill holes with corresponding gold assays and interpretation grade shells shown in Seequent Evo 3D viewer.

Drill holes with corresponding gold assays and interpretation grade shells shown in Seequent Evo 3D viewer.Seequent products are used by eight of the 10 largest mining companies in the world—including Rio Tinto, BHP, and Newmont—and many of the smaller ones. And while each of these tools is industry-leading in its own right, Seequent is now enabling them to connect and evolve into something next-level.

That unifying force is Seequent Evo—a newly launched cloud platform designed to connect data, teams, and tools in a single, collaborative environment. It represents a shift from standalone or patchwork software combinations to a fully integrated data ecosystem.

Evo marks a new era of digital mining. It consolidates all geoscience data—not just from Seequent, but also third-party applications—into a readily updatable and auditable single source of truth. Through open APIs and secure cloud workspaces, Evo frees geological data from its many silos and makes it possible to visualize and share insights across teams, tools, and territories.

At Evo’s official launch at the 2025 convention of the Prospectors & Developers Association (PDAC) in March, the president of the Northern Miner Group, Anthony Vaccaro, said Evo was “breaking down these walled gardens [and] making data more accessible than ever before. And it allows companies to share and transfer geological insights without needing a Ph.D. in decoding someone else’s filing system.”

This openness is a game-changer in a field where data has historically been locked away in proprietary formats, said Grant, Seequent’s CEO. “We are used to coming in from left field, and with Evo, we are coming in from left field. We are swimming in the complete opposite direction to everyone else. And we think that’s going to unlock unbelievable levels of value for our mining customers and for that we are super excited.”

Just as Bentley champions digital twins through its iTwin platform, Seequent Evo represents the subsurface expression of that vision, turning scattered insights into a living, evolving model of the underground. And in a business built on ground truth, Evo is helping redefine what that really means.

A new generation of tools

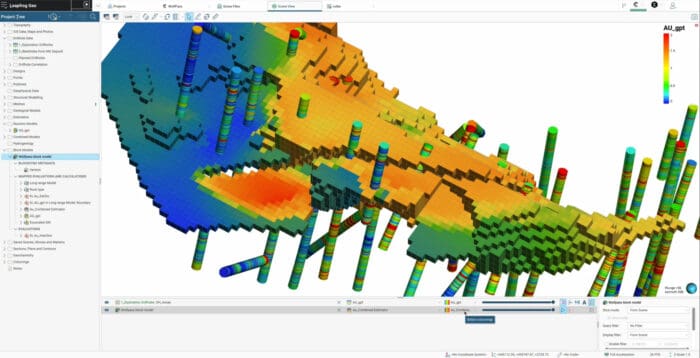

BlockSync block model in Leapfrog showing estimated gold grade variability alongside drilling.

BlockSync block model in Leapfrog showing estimated gold grade variability alongside drilling.Evo brings with it its own new generation of pioneering tools. BlockSync, for example, builds on Leapfrog Edge and reforms the reconciliation process in grade control—essentially mineral concentration control—by transforming block modeling into a dynamic, cloud-based process. Here, teams can access, update, and review the same model in real time—ensuring consistency and eliminating version chaos.

Another tool, Driver, applies machine learning to drillhole structural data, accelerating exploratory analysis and uncovering patterns that might otherwise go unseen. “[Driver is] like spinning up a turbocharger on the idea of understanding structural trends and what’s going on in your deposit,” Grant says. “It’s amazing.”

The buzz surrounding Evo at PDAC reflected the industry’s appetite for more knowledge. With gold at record highs and legacy assets back in focus, platforms like Evo—and the tools built on top of it—are becoming available at exactly the right time.

Better for business and the planet

Accurate modeling isn’t just good for the bottom line—it’s essential for sustainability. “If you can move less rock for more gold, it’s not only cheaper, it’s less environmentally damaging,” Newton points out. And not just in terms of physical disruption, but also in terms of emissions from heavy, diesel-powered mining machinery.

The benefits extend beyond the mine site. In Canada, for example, many old mines sit on or near First Nations land, in remote areas where job opportunities can be scarce. When data makes a project viable again, it can bring with it employment, training, and long-term investment. “A mine that wasn’t economic before can suddenly help support a community,” Newton says.

This shift toward smarter, more sustainable mining is accelerating, and at its heart is a digital transformation that’s reshaping the entire industry.

Mining’s digital future

Mining is leaving behind paper logs, isolated models, and educated guesswork—and embracing a new era of integrated data, real-time collaboration, and AI-powered analysis. With Evo, every stage of the process—from the first core sample to the final investment decision—is integrated into a connected, living model designed not just for precision, but for transparency, confidence, and agility.

The core shack, however, is still a reality. The difference now is what happens next. That rock becomes precision data—and that data joins an ecosystem capable of producing unprecedented insights that could mean the difference between reopening a mine or leaving millions in the ground.

“The transition to digital in mining is still in its early days—barely twenty years in,” Newton says. “But Evo is genuinely revolutionary. It’s not just a platform—it’s a foundation. What comes next in mining will be built on top of it.”