Infrastructure is the linchpin that holds together the journey of entire nations towards economic and social prosperity. Ensuring that roads, bridges, hospitals, and other vital structures are built effectively and efficiently requires an in-depth understanding risks and their allocation in infrastructure development. Digital tools can provide a clearer view of when, where, and who is making decisions and enables risk allocation to be more equitably allocated. A well-thought-out model for risk allocation is necessary, yet the current paradigm often burdens contractors and subcontractors in an unbalanced manner. The concept of ‘risk’ in infrastructure, as described by experts like Ellis Baker, Richard Hill, and Ibaad Hakim, encompasses any ‘uncertain event or set of circumstances that, if they occur, will have an impact on achieving one or more of a project’s objectives’.

At a high level, risk in infrastructure is fundamentally about not meeting the business case. However, beyond that, and perhaps most importantly, is the risk of not delivering value to the public.

Understanding the Current Risk Landscape

Risk allocation is not merely a contractual necessity but serves as a crucial aspect of the complex ecosystem of infrastructure project management. In the realm of engineering and construction, risks are complex and multifaceted, ranging from project specific risks, such as the level of front-end design or pre-construction project development, to global financial uncertainty and climate risks. It may be tempting to simplify these complexities when it comes time to draw up contracts, however effectively allocating risks to the appropriate parties requires careful consideration to maximize the chance of delivery success.

A Historical Perspective: The Evolution of Contractual Documentation

In the not-so-distant past, the responsibility for infrastructure projects largely fell on government agencies. Agencies would lead these initiatives in-house, and inherently manage most of the risk. However, the landscape has changed substantially with the rise of public-private partnerships. These partnerships have provided a range of benefits including unlocking capital that would otherwise not be available for infrastructure delivery. But they have also muddied the waters of risk allocation, often tilting it towards the private entities involved. Most standard form contracts, though designed with the intent of ‘fair and balanced’ risk allocation, often fail to deliver on this promise. The gap between intent and practice needs to be bridged to mitigate systemic inefficiencies that plague the industry.

When risk is not properly allocated, the repercussions can be significant and far-reaching. These include not only delays in construction schedules but also inefficient utilisation of resources and a growth in project costs. This situation becomes even more problematic as it lowers investor confidence, hampering the likelihood of securing funding for future projects. The domino effect of poor risk allocation extends beyond a single project and can have detrimental impacts on the entire infrastructure ecosystem. Not understanding and effectively allocating risks destroys capital effectiveness, leaving the public with less infrastructure bang for their taxpayer buck.

Guiding Principles for Equitable Risk Allocation

The quest for equitable risk allocation in infrastructure projects is a nuanced and complex undertaking. Unlike a generic blueprint that could be applied uniformly, it demands a more tailored approach grounded in several fundamental principles, as set out below.

Capacity for Control Over the Risk

One of the cornerstones of risk allocation is the concept of control. Risks should be allocated to the party most capable of managing, mitigating, or eliminating them. This capacity for control is multi-dimensional and includes technical expertise, administrative capability, and financial resilience.

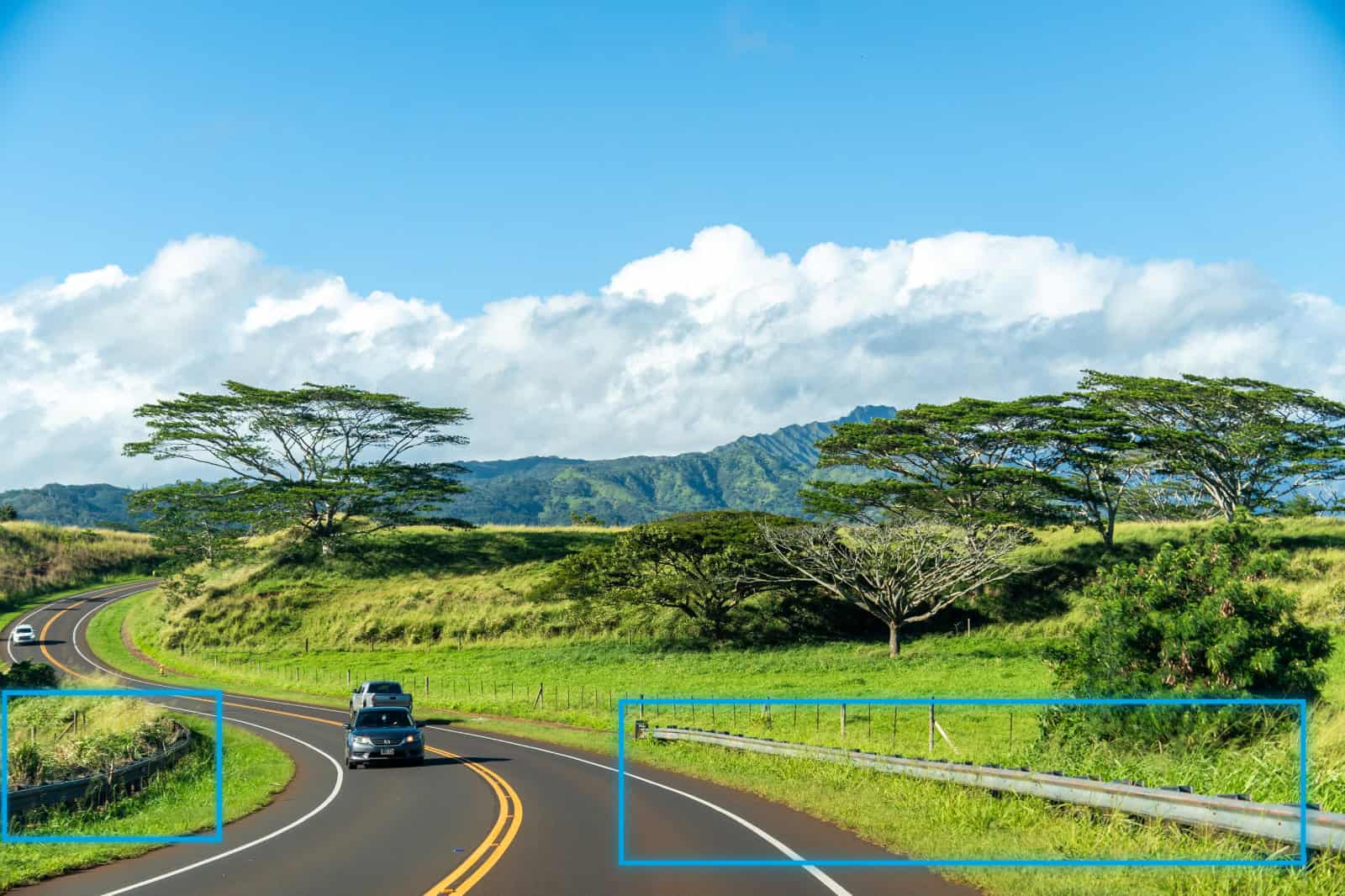

For example, in a construction project, geotechnical risks related to soil and rock conditions could be allocated to contractors with the necessary engineering capabilities to assess and manage them effectively. However, allocating geotechnical risks to the contractor without it having an overall impact on the project is a complex and perhaps futile exercise. Since soil and hydrology is the foundation of everything we build, it cannot be decoupled from everything else.

Geotechnical conditions can have a large influence on the design of a project, and consequently a massive influence on the cost estimate. Therefore, it is improbable that the project owner can arrive at a reliable cost estimate for the whole project without understanding the geotechnical conditions.

Economic Benefits or Drawbacks Related to Risk Control

Allocating risks also entails a comprehensive economic analysis. Each party’s capability to shoulder financial burdens should be closely examined, alongside the economic advantages or disadvantages arising from their control over specific risks.

In certain scenarios, a party might be technically equipped to manage a risk but financially incapable of absorbing its potential economic consequences. On the other hand, some parties may stand to gain significant economic advantages through risk management, such as technology firms who could benefit from data they collect during an infrastructure project. Understanding the economic intricacies tied to risk control is essential for a balanced allocation.

Efficiency Gains

Efficiency gains related to risk allocation are often underestimated but are crucial. Properly allocating risks can lead to better project planning, increased motivation for high-quality work, and an environment conducive to innovation.

Preparation and pre-planning for major projects is of major importance. Proper planning ensures potential challenges are identified early, resources are allocated effectively, and the resolution of issues is aligned with the overall project objectives. In fact, industry leaders rated insufficiency in pre-construction project development and risk identification the second most impactful element on market capacity and capability in recent research conducted in Australia, behind only the allocation of risk in contracts.

For instance, when a contractor knows they are responsible for timely completion and are at risk of financial penalties for delays, there’s an intrinsic motivation to plan meticulously and execute efficiently within their sphere of influence. Similarly, a well-structured risk allocation model can promote innovation by encouraging parties to develop creative solutions to manage or mitigate risks for which they are responsible.

Influence of Market Dynamics

While these principles offer a structured approach to risk allocation, they cannot be applied in isolation from the broader market dynamics. Economic conditions, industry trends, and even geopolitical events can all impact the practicality and fairness of risk allocation models.

For instance, during a market downturn, the private sector might be less willing to accept significant risks, shifting the negotiation power towards governmental agencies. Conversely, in a booming market, contractors might be more willing to assume more substantial risks in anticipation of higher returns.

Tailoring to Project-Specific Needs

The principles discussed above serve as a foundational framework but must be tailored to align with the unique attributes, goals, and financial structure of each individual project. This involves collaborative dialogues between all stakeholders, including financiers, to craft a risk allocation strategy that offers an equitable distribution of benefits and responsibilities.

The complexities of each project, whether it be a small-scale local initiative or a multi-billion-dollar national scheme, demand a thorough assessment of risk. This assessment, guided by these foundational principles and adapted to the specific project, creates the basis for a fair and effective risk allocation model.

In sum, equitable risk allocation is an intricate exercise that combines control capabilities, economic considerations, efficiency gains, market influences, and project-specific attributes into a cohesive strategy. Through a deeper understanding and application of these principles, stakeholders can achieve a more balanced and fair risk allocation, serving not only their interests but also the greater good of sustainable and equitable infrastructure development.

Towards a Balanced Risk Allocation Landscape

The pathway to achieving a more balanced risk landscape lies in a nuanced understanding of each project’s unique risk profile. Experts like Nael Bunni offer a pragmatic approach, suggesting that risk be allocated based on which entity is best positioned to control, foresee, manage, and bear it.

The next step involves taking a multi-faceted strategy that combines these principles with a granular understanding of the project’s specific risks. This involves not only close collaboration between public and private sectors but also input from legal and financial experts who can navigate the complexities of risk allocation.

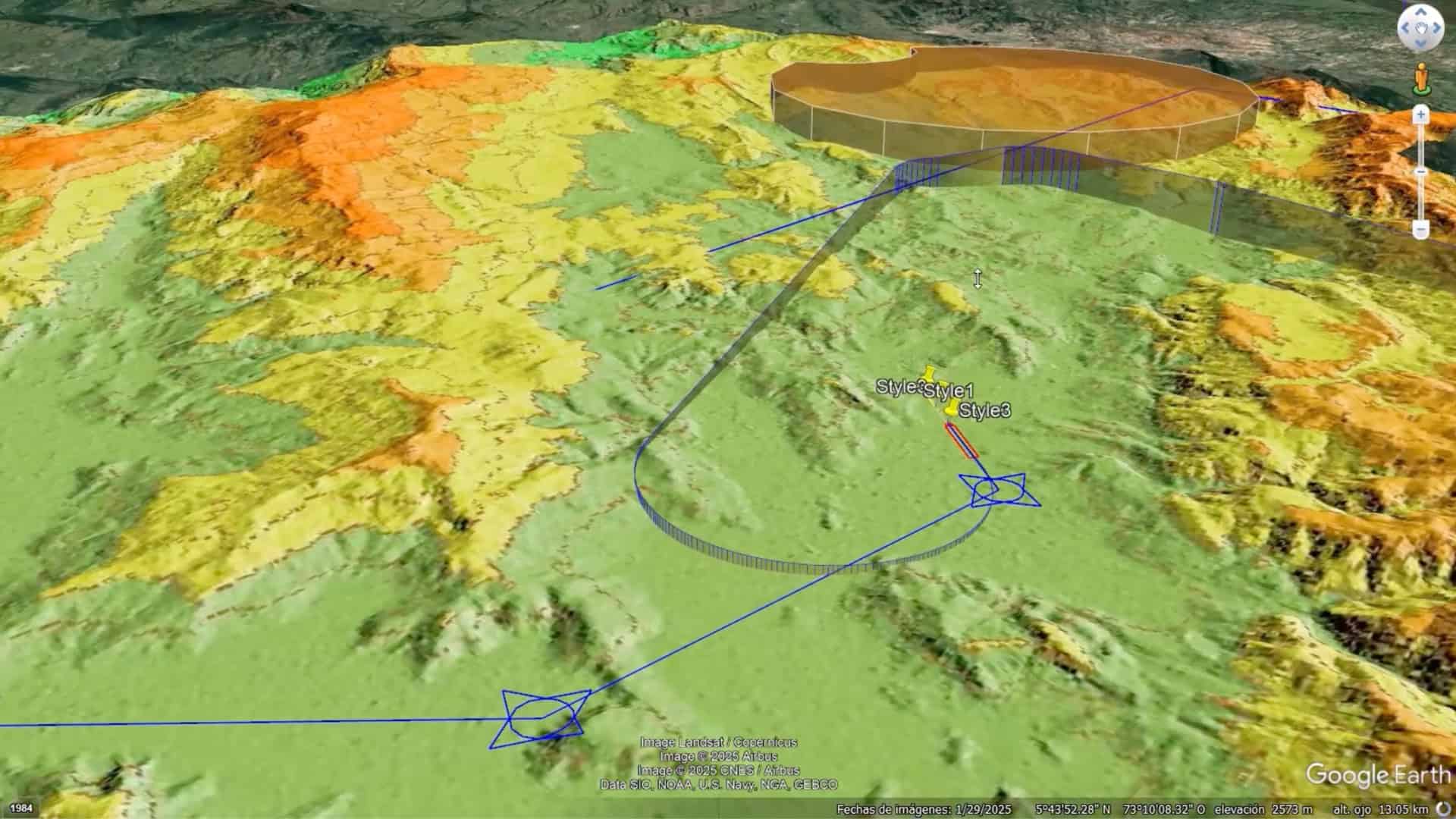

Digital tools have revolutionized infrastructure delivery by offering enhanced transparency in decision-making processes. They empower stakeholders with a clearer understanding of the “when,” “where,” and “who” behind crucial risk-related decisions – ensuring greater accountability and efficiency. Moreover, these tools offer a fairer allocation of risk to involved parties. This digital transformation also fosters trust and innovation – paving the way for more successful projects.

The utilization of digital tools in infrastructure delivery can facilitate real-time data sharing and analysis, facilitating rapid adjustment and data-driven decision-making. Project teams can monitor risks and make necessary adjustments quickly, reducing delays and cost overruns. Additionally, these tools can harness the power of analytics, automation and modeling – driving positive project outcomes and supporting resilience and adaptability across the built environment.

The Need for Reform

The topic of risk allocation in infrastructure is an intricate web of complexities, but one that cannot be ignored given its critical role in the success of projects. For the sector to continue to develop its infrastructure in a manner that is both efficient and equitable, there is an urgent need for reform in how risks are allocated. Legal insights, academic research, and industry best practices all offer valuable perspectives that can serve as a robust foundation for these reforms.

By adopting a more balanced approach to risk allocation and tapping into the power of digital tools to help with the process, governments can ensure the successful execution of individual projects while also contributing to national objectives such as sustainable growth, job creation, and equitable development.