The banking sector has long been at the forefront of leveraging data and technology to make better decisions, reduce risk, and enhance return on investment. Taking on today’s major challenges – climate change, energy, and healthcare, to mention a few – requires having access to data, supported by the right technology, to ensure the right outcomes.

Digital twins – a realistic and dynamic digital representation of physical assets, processes, or systems in the built or natural environment, are one of the most significant technological advancements of the last decade. Just like BIM almost 20 years ago, they are reshaping how infrastructure is planned, designed, built, and operated today, and are critical to developing infrastructure that will sustain future generations around the world.

Here in the United Kingdom, the Centre for Digital Built Britain (CDBB), a collaboration between the University of Cambridge and the Department for Business, Energy, and Industry Strategy, has seen first-hand how digital twins can improve decision-making in asset planning, design, build, and operation, as well as the benefits of connecting the technology across organizations and sectors.

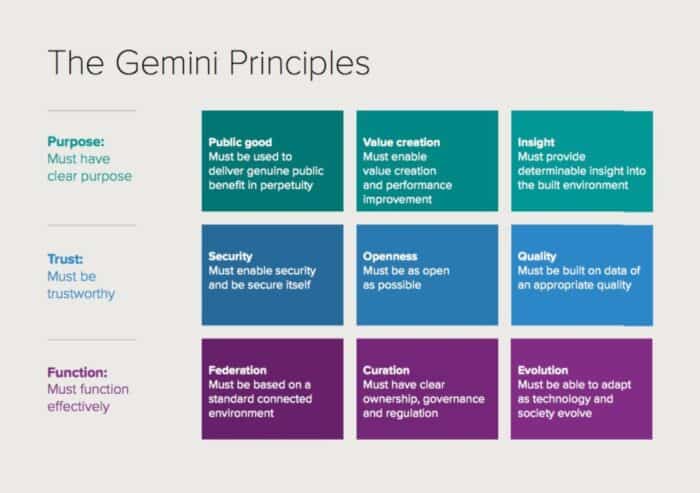

CDBB pioneered the creation of the UK’s national digital twin project, creating an ecosystem of linked digital twins that can securely communicate infrastructure information in real-time to enable better results, based on the Gemini Principles. A set of ethical principles that the CDBB believes should apply to any digital endeavor in the infrastructure sector, the Gemini Principles are founded on the premise that all digital twins must have a clear purpose, must be trustworthy, and must function effectively.

The Gemini Principles were established by the Center for Digital Built Britain to guide Britain’s national digital twin and the information management framework that will enable it. Image courtesy of The Center for Digital Built Britain.

The Gemini Principles were established by the Center for Digital Built Britain to guide Britain’s national digital twin and the information management framework that will enable it. Image courtesy of The Center for Digital Built Britain.Discussing the findings of CDBB’s most recent whitepaper ‘How finance and digital twins can shape a better future for the planet’ in the May 25 episode of ‘The Engineers Collective’, former executive director of CDBB Alexandra Bolton commented that in order to meet our biggest challenges “adoption of the Gemini Principles, ensuring data is open and shared in a secure and resilient fashion, and collaboration, was absolutely vital, as none of us either individually or as our organizations can do this alone, we need to collaborate to make this work.”

Bolton continued, “Think about data as an asset that becomes more valuable when its shared and think about data not just from your new assets that you might be building, but from existing assets, and think about that data across the whole lifecycle, across sectors, and across boundaries.”

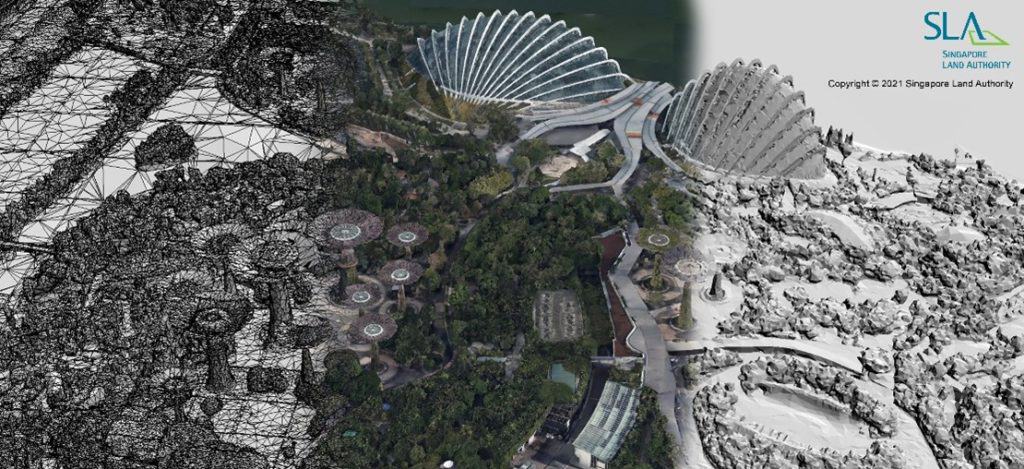

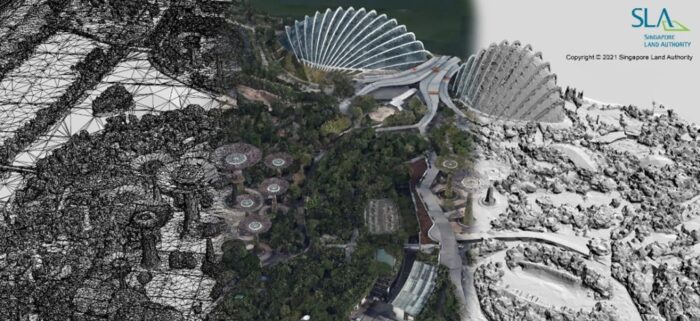

If this sounds like a step too far, an impossible dream, consider Singapore, which just became the first government to build a country-wide digital twin. Open data, connected systems, and technology will aid in the building of more sustainable, resilient, and smart communities, as well as in the deployment of renewable energy and protection against climate change and rising sea levels.

Singapore is the first government to build a country-wide digital twin.

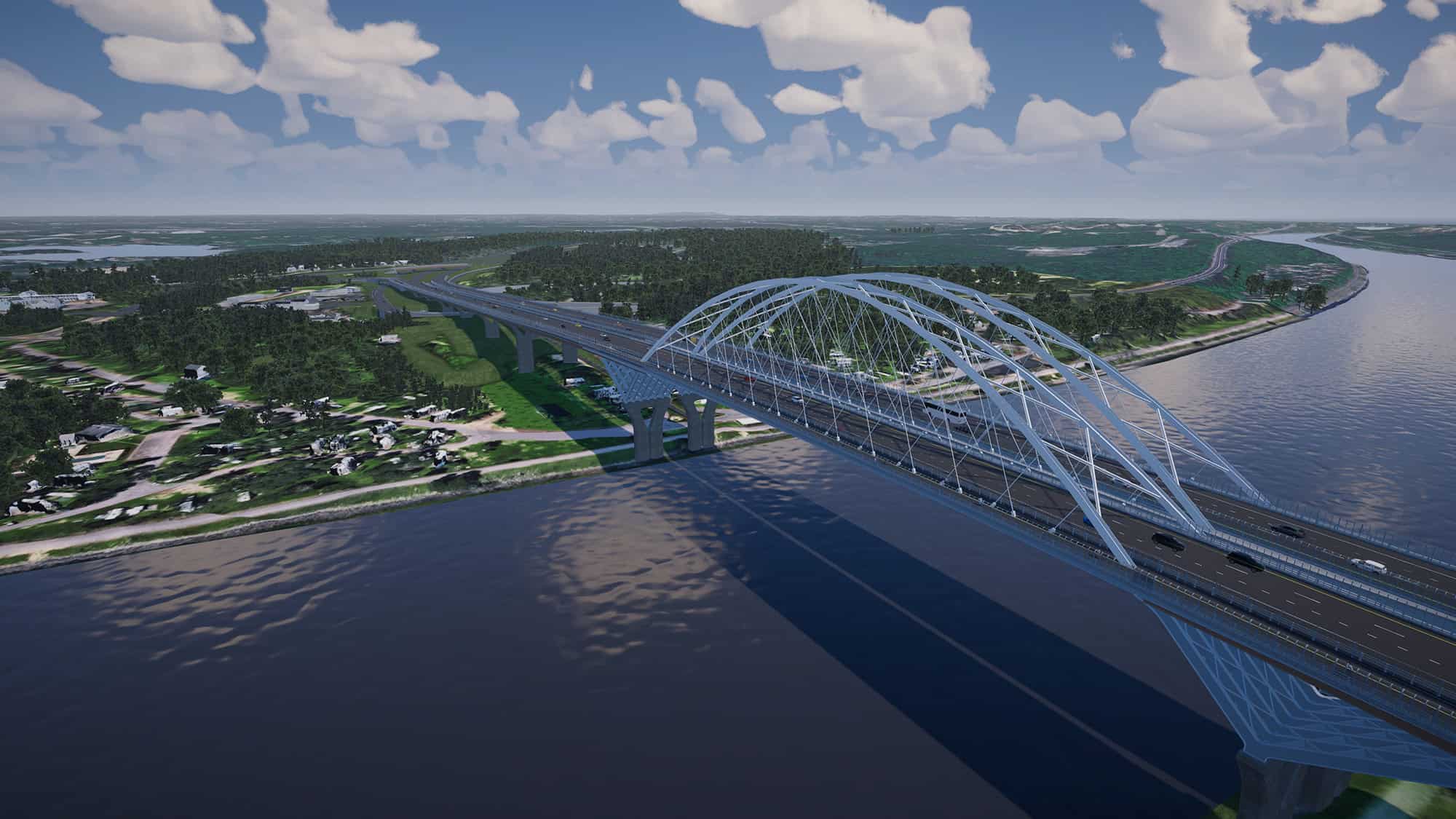

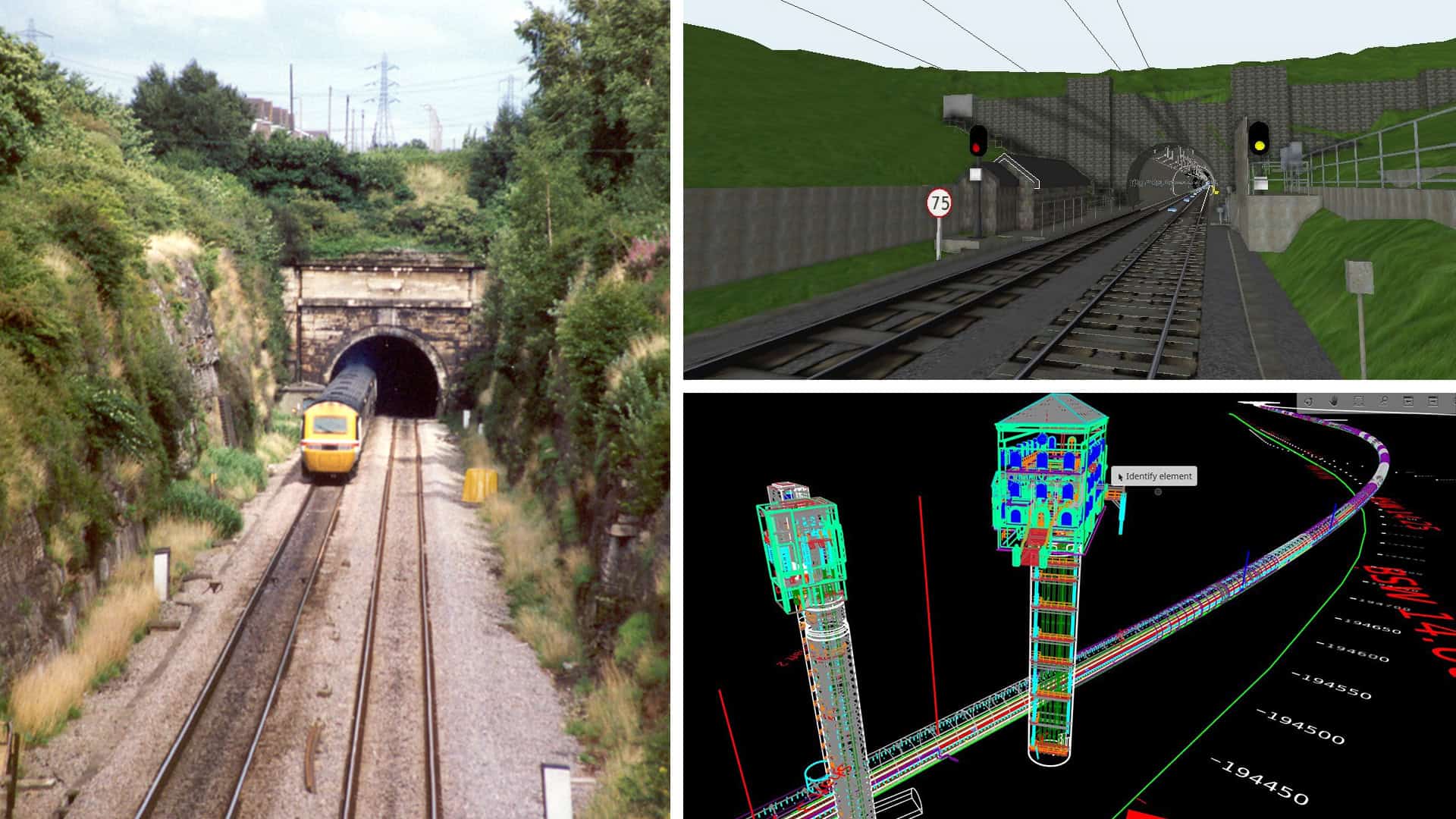

Singapore is the first government to build a country-wide digital twin.Another example of a publicly funded mega-project that can serve as a catalyst for a city-level digital twin, is Cross River Rail in Brisbane, Australia. The Cross River Rail project is a 10.2 kilometer section of rail which includes 5.9 kilometers of tunnel under the Brisbane River, 6 new stations – 4 underground and 2 on the surface, plus upgrades to 6 existing stations, all aimed at making public transport more attractive and removing existing bottlenecks in Brisbane’s public transport.

The AUD $5.4 billion project, which started construction in 2019 and is due to be operational by 2025, is already unlocking future investment in residential and commercial properties and was a key component of the City of Brisbane’s successful bid to host the 2032 Summer Olympics, given its alignment with the International Olympic Committee’s criteria for having the games blend in with, and be catalytic to, the growth of host cities versus a one-off two-week event.

Multi-environment digital twins that continually communicate with one another are at the heart of the project ‘digital network approach’, and its benefits extend beyond digital engineering to provide a better understanding of the interconnected nature of proposed assets with associated infrastructure within and beyond station environs. Andrew Curthoys, digital delivery manager at Cross River Rail comments “they (digital twins) allow us to plan for the life of the project, cast forward to what it will be like, with the advantage of a full digital representation that can be used for additional tasks including the ongoing operations and maintenance.”

Cross River Rail’s CEO Graeme Newton expects that in comparison to the benefits digital twins provide, the cost of creating and maintaining them is insignificant, and that investment in digital twin technology will just become the norm. Newton believes future owner-operators will ask “What have been the (data) inputs into all of these things? How are you maintaining the standard you said you would? How do we know that safety is paramount? The digital twin means it is forever captured and its forever represented and its forever traceable.”

The problems being handled by digital twins in Singapore and Brisbane are comparable to those that are affecting or will soon impact the UK, but the technology has additional applications. For example, the Grenfell Tower catastrophe has refocused government and regulators on the safety of higher-risk structures, while national and international banks must explain the effect of their investments against economic, social, and environmental (ESG) criteria.

The banking community, as important investors, has a significant chance to reap the benefits of digital twins by employing them to provide value, follow sustainability objectives, attract new investments, and better manage risk.

The Rise of Digital Twins

Over the last few years, there has been a surge of interest in the potential role of digital twins, particularly in how the technology is transforming how infrastructure is planned, developed, built, and operated. So much so that current digital techniques, including digital twins, are at the center of an emergent government-industry reform effort, and have been cited in major papers such as the Construction Playbook, the Transforming Infrastructure Performance Road Map to 2030, and the Gemini Papers.

Since the CDBB program’s inception in 2017, there has been a significant improvement in the quality of conversation among industry, academia, and the public sector. Discussions have resulted in a deeper understanding of the applications and benefits of infrastructure digital twins, as well as increased investment in the technology, but can the same be true of negotiations between the infrastructure business and the investors, insurers, banks, and other organizations that supply a large portion of their funding and finance?

After speaking with a diverse group of investors, the report concludes that the finance community can leverage the potential of digital twins for infrastructure to support investment decisions, and in doing so promote better outcomes from the infrastructure in which they are investing. Furthermore, by playing a larger role in the digital transformation of infrastructure, investors can help enterprises, people, and the environment, Alexandra Bolton stating that she believed “the finance community has a huge opportunity to use their influence not only to create these lower risk, higher profit investments, but to create a greener, fairer, safer future.”

Collaborating across the information value chain

There is also a significant opportunity to use digital twins to help the investment community with key challenges such as capital allocation, risk screening and management, asset value enhancement through improved performance and reliability, and compliance with environmental, social, and governance (ESG) requirements.

ESG loans have become increasingly widespread, and new professions in the financial sector are being formed to focus on ESG-related investments. My colleague, Mark Coates, International Director of Public Policy and Advocacy at Bentley Systems recently published a white paper that looked at ‘The Power of Data for Long-Lasting Change’ (direct download of white paper available here) in which he highlighted that in February 2020, Great Portland Estates signed a GBP 450 million, ESG-linked, revolving credit facility with a group of five banks, as part of its plans to become net-zero by 2030.

The basics of the information value chain must be applied to harness this potential. The financial community can assist in using data insights to tackle their most pressing challenges by engaging with the entire sector to build realistic use cases. The infrastructure industry must contribute by approaching this debate with openness and flexibility. They must also understand that investors create returns on investment in several ways, through various asset types and at various phases of the infrastructure lifecycle. Some of their use cases will overlap with those established before for supply chain enterprises or operators, while others will not.

We must first improve the quality of dialogue between investors and other stakeholders in the infrastructure sector, reimagine the information value chain from an investor’s perspective, investigate how investors can expand their leadership role, and share some use cases that investors are currently pursuing. There are three critical phases to doing this: First the infrastructure industry needs to recognize the many different infrastructure investors and what this entails for the various ways in which they might profit from digital twins. Second, recognize how investors classify infrastructure. And third, connect digital twin use cases to various investing strategies.

Understanding how investors categorize opportunities in the infrastructure sector.

Understanding how investors categorize opportunities in the infrastructure sector.Investing in a Long-Term Future

Collaboration among infrastructure sector stakeholders and investors is essential for constructing better, more sustainable infrastructure. We can do remarkable things when we work across the whole lifecycle, boundaries, sectors, and borders. We can make better business decisions that result in better economic, social, and environmental results.

There has already been progress. It’s happening in some places already, but to allow us to do the scenario planning on our big complex systems, we need our transport systems connected with our housing systems, our energy systems, with our hospital and social care systems, so that we can truly make the decisions that we need to make.

With digital twin spending expected to reach $27.6 billion by 2040, it will be fascinating to see how the financial sector collaborates with the larger infrastructure community and solution providers to employ higher quality data and digital twins to increase investment returns, satisfy ESG targets, and build the sustainable future we all desire.