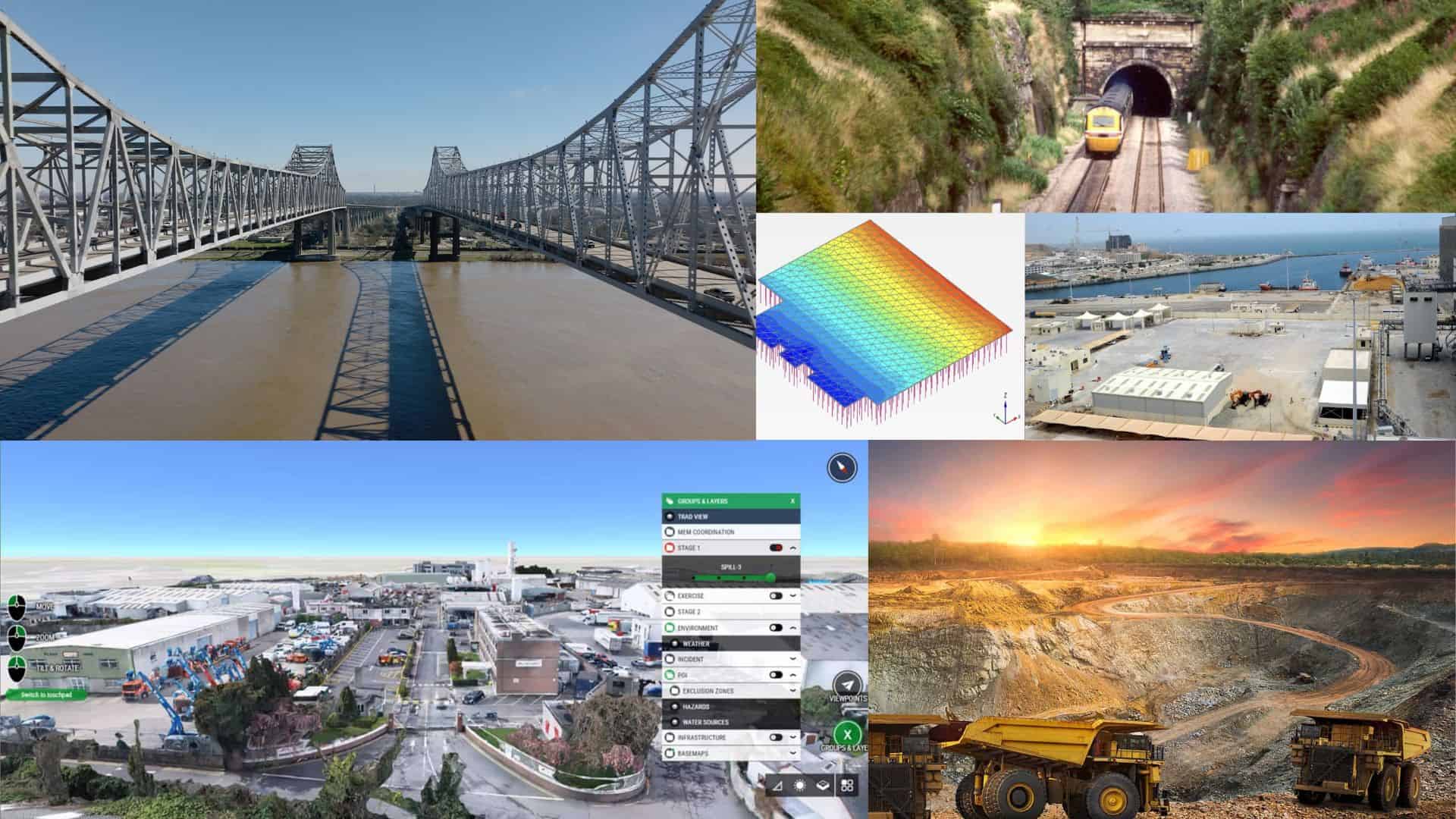

A digital twin proved crucial when a transmission tower supplying electricity to a U.S. hospital was damaged during the COVID-19 pandemic. High-tech models reduced water loss in drought-hit Colombia, and a virtual replica improved sustainability at a university campus in Lithuania.

What all these projects have in common is the use of digital tools to make infrastructure assets more sustainable and resilient in the face of the huge challenges—such as climate change and urbanization—that are straining the world’s critical infrastructure.

To coincide with Earth Day, and the release of Bentley Systems’ Impact Report 2024, here are six case studies that illustrate how users of Bentley software are helping to accelerate the transition to a low-carbon future.

Each project addresses a challenge related to energy transition—the theme of this year’s Earth Day—by helping generate renewable energy, secure its transmission, or make cities more energy efficient.

How a Digital Twin Helped Fix a Critical Grid Tower in Missouri

Digital twin technology was used to determine a stabilization solution to avoid a catastrophic power outage.

Digital twin technology was used to determine a stabilization solution to avoid a catastrophic power outage.For a power line in central Missouri, it was a perfect storm. During the COVID-19 pandemic, an inspection by Midwestern energy utility Evergy revealed that flooding had damaged one of the transmission towers on the 161-kilovolt Clinton Stillwell Line. Construction on an adjacent major power line meant the damaged tower was the only source of power to the region. Local hospitals were filled with COVID-19 patients, meaning a loss of power would be catastrophic. The solution: Evergy used innovative digital solutions from Bentley to create a digital twin of the damaged tower. The high-resolution drone imagery and 3D modeling enabled the team to assess structural deflection and to design emergency stabilization—all while keeping the power line energized. Using a digital twin shaved off four to six weeks of design work. It allowed Evergy to stabilize the structure within two months and avert a prolonged outage.

Reducing Drilling Needs at an Indonesian Nickel-Cobalt Mine

Seequent’s innovative data workflow solution, MX Deposit and Imago, together with 3D modelling and estimation in Leapfrog Geo and Edge, help the SMGC team explore what nickel is in the ground, and where (Image: SMGC).

Seequent’s innovative data workflow solution, MX Deposit and Imago, together with 3D modelling and estimation in Leapfrog Geo and Edge, help the SMGC team explore what nickel is in the ground, and where (Image: SMGC).Nickel and cobalt are essential ingredients in the batteries powering clean energy, and Indonesia is a global powerhouse in the production of both. As demand increases for these and other critical minerals, Indonesia’s PT SMG Consultants (SMGC) partnered with Seequent, the Bentley subsurface company, to harness the power of digital tools to achieve responsible mining. The project—the Transformative Innovations in Southeast Sulawesi Nickel-Cobalt Exploration—optimized nickel extraction using digital twins, advanced 3D geological modeling and integrated data management solutions. The project cut drilling needs by 80% and saved substantial energy, water carbon dioxide emissions. The pioneering approach advanced critical mineral production and set a benchmark for sustainable practices, directly supporting a cleaner global energy transition.

The World’s First Hydrogen Metallurgy Engineering Plant Cut Carbon Emissions by 70%

The digital twin helped MCC Capital Engineering & Research Incorporation Limited (CERI) complete the hydrogen metallurgy engineering plant in two years, shortening the construction period by 33.33%.

The digital twin helped MCC Capital Engineering & Research Incorporation Limited (CERI) complete the hydrogen metallurgy engineering plant in two years, shortening the construction period by 33.33%.Iron and steel production are major sources of greenhouse gases. But what if one of the byproduct gases could be used in a key steel-making process? That’s what MCC Capital Engineering & Research Incorporation Limited (CERI) set out to do when it developed the world’s first hydrogen metallurgy engineering plant in Zhangjiakou, China. CERI designed a breakthrough process that uses hydrogen-rich coke-oven gas instead of coal, which is traditionally used in smelting. To do so, CERI used Bentley applications for real-time data sharing and precise modeling to create a digital twin of the project. Another set of tools helped CERI implement enhanced safety standards. The digital twin lowered costs by shaving years off construction time and reduced the plant’s water and energy usage needs by more than 50%. The plant also reduced carbon emissions by 70%—the equivalent of 800,000 tons annually—when compared to traditional methods.

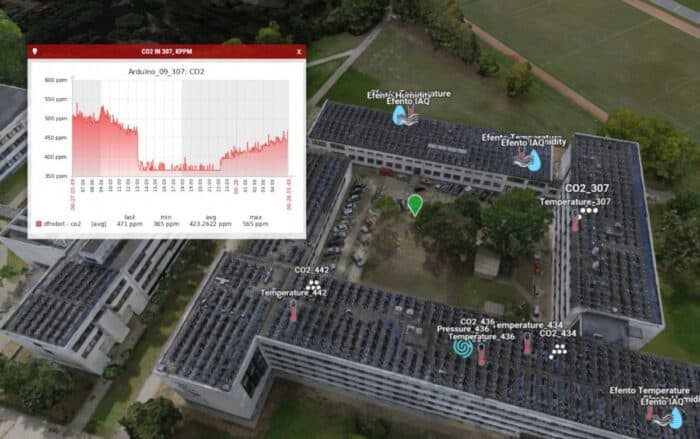

Digital Twin of a University Campus in Lithuania is Helping to Improve Building Sustainability

The Kaunas Digital Twin is linked to IoT devices that stream a number of sustainability and human comfort indicators such as air quality data and temperature levels. Courtesy of Kaunas Technical University

The Kaunas Digital Twin is linked to IoT devices that stream a number of sustainability and human comfort indicators such as air quality data and temperature levels. Courtesy of Kaunas Technical UniversityLithuania has set ambitious goals for improving the emissions performance of its buildings—and it’s getting support from Bentley through a project at Kaunas University of Technology (KTU). The project has created a digital twin of KTU’s buildings that reveals their energy consumption, waste and carbon dioxide impacts across campus. The initiative promotes energy efficiency and greenhouse gas reduction by implementing solar energy, electric vehicle (EV) charging and targeted resource management. The project supports Lithuania in its carbon goals while preparing KTU students to help digitize the architecture, engineering and construction sector.

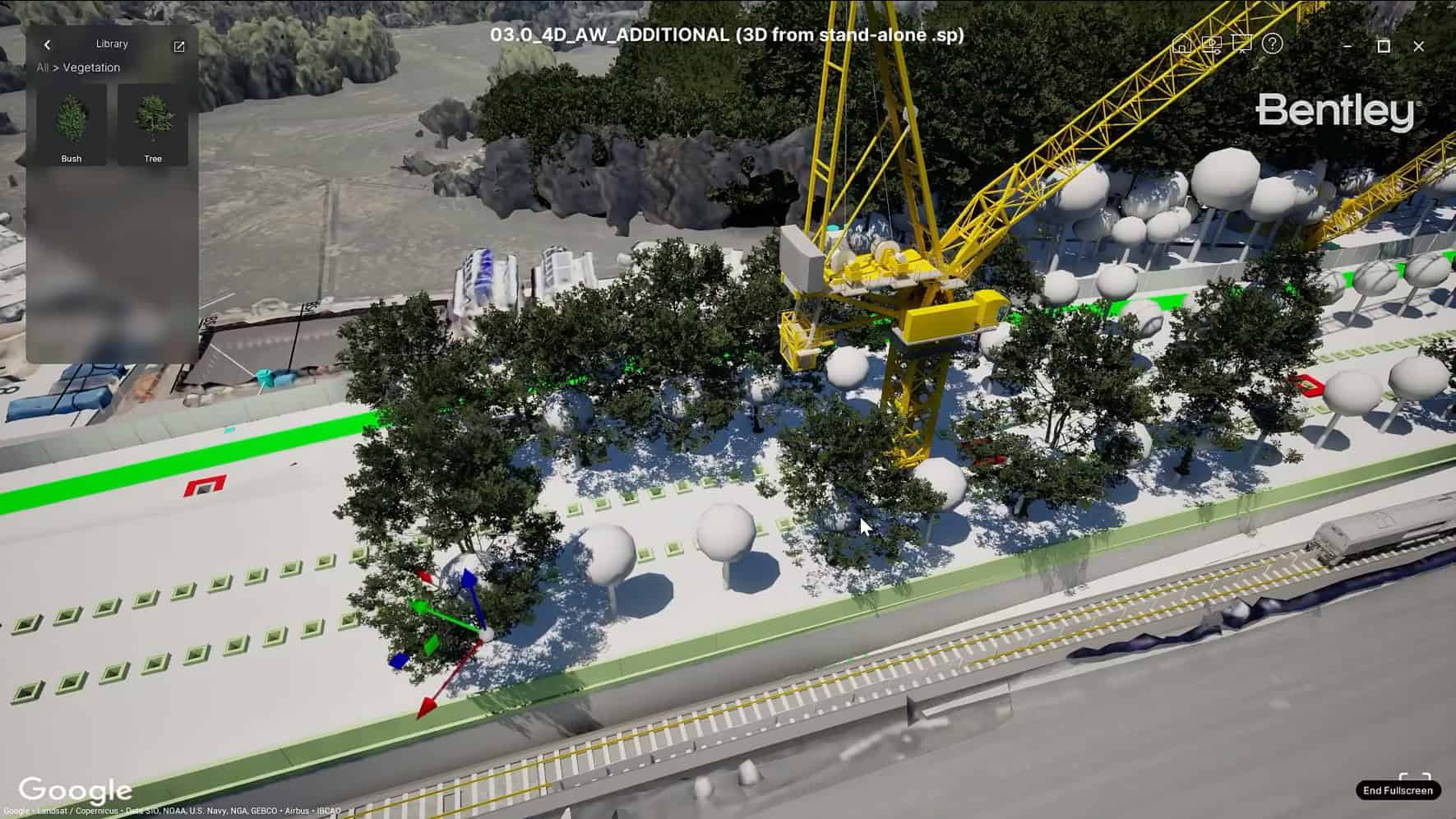

A Digital Model Optimized Water Distribution in Drought-Stricken Colombia

A severe drought across South America last year led authorities in Colombia to ration water in the capital city of Bogota for the first time in more than 40 years. Amid the crisis and facing increasing demand for water, a utility in the northern city of Bucaramanga launched a project to optimize water distribution. The utility, Acueducto Metropolitano de Bucaramanga S.A. E.S.P., used Bentley’s WaterGEMS software to create a real-time digital model of the water system. With WaterGEMS’ capabilities, the project decreased modeling time by 25% and reduced water loss by 5%, which recovered an estimated 7,000 cubic meters of water each month, enough to fill nearly three Olympic-size swimming pools. The initiative also cut the need for on-site visits, a move that further reduced energy and fuel consumption. The project shows how digital solutions can transform infrastructure resilience, supporting both environmental sustainability and community well-being in a time of climate urgency.

How PowerChina ZhongNan Built a Massive Wind Farm in Less Than a Year

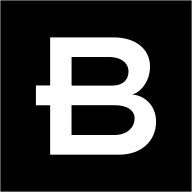

Engineers used Bentley software to help create a digital twin the Bozhong Offshore Wind Farm Site A.

Engineers used Bentley software to help create a digital twin the Bozhong Offshore Wind Farm Site A.Renewable energy is key to weaning the world off fossil fuels and reducing the carbon emissions that are driving climate change. That’s why the PowerChina ZhongNan Engineering Corporation Limited decided to replace coal with wind in China’s Shandong province. The challenging project was the first wind farm in the country operating at “grid parity,” meaning it could generate electricity at the same price or lower with wind that it could with coal. To make the stakes higher, the project—the Bozhong Offshore Wind Farm Site A—had to be completed within one year despite challenging seabed conditions at the site. Engineers turned to Bentley to help create a digital twin of the wind farm, a move that increased efficiency by 30% while reducing project costs. The offshore wind farm—one of China’s largest when it came online in 2022—was completed on schedule and now has the potential to provide 500 megawatts of power through 60 wind turbines. It also saves more than half a million tons of coal per year, reducing carbon dioxide emissions by 1.25 million tons a year. Bentley software also helped engineers optimize the foundations of the turbines and eliminated the need for 8,557 tons of material, significantly lowering development costs.